Lo's RVRental Protection Plans: Everything You Need to Know

Renting an RV ought to be a hassle-free experience. This is the reason why Lo’s RVRental provides top-tier protection plans, crafted to ensure that guests, hosts, and their RVs are safeguarded—allowing you to concentrate on your adventure.

How it works

When booking your RV, you will select a protection plan that restricts your financial liability for qualifying damages. The options for these plans vary based on the type of vehicle you are renting in the United States.

Depending on the plan you select, you’ll also enjoy additional benefits like enhanced roadside assistance, trip interruption coverage, and additional damage protection.

Lo's RVRental Protection Plans

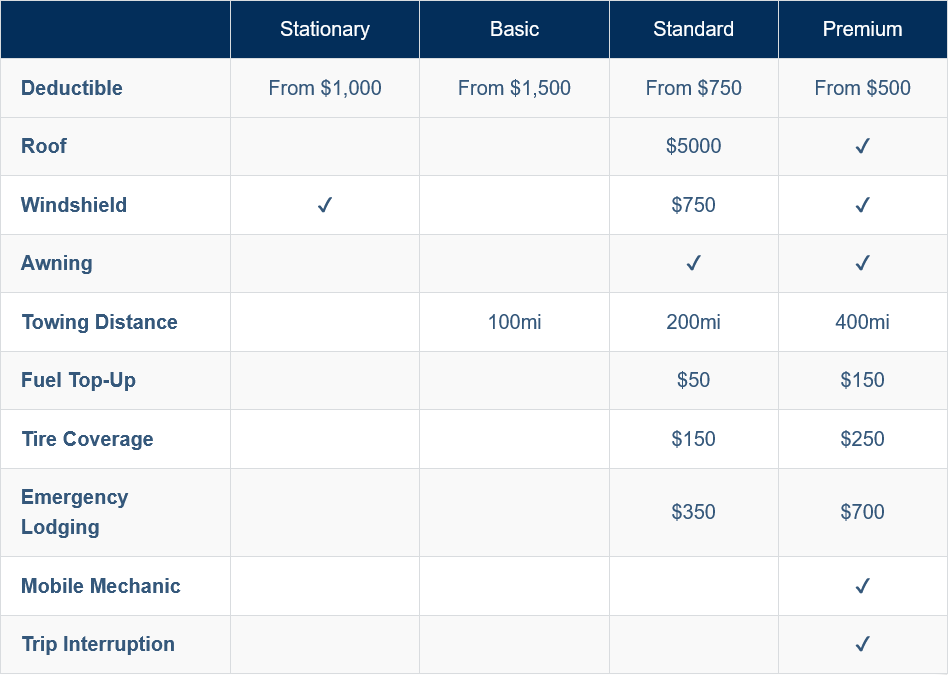

Lo’s RVRental offers four tailored protection plans—Basic, Standard, Premium, and Stationary—to suit various needs. Here’s a breakdown of each option:

All plans include State minimum liability, physical damage coverage, and 24-hour roadside assistance.

Lo's RVRental Protection Plans

The right protection plan depends on your trip details, like the type of RV you’re renting, your destination, your RVing experience, and how comfortable you are with out-of-pocket expenses if damages occur.

Basic

- Designed for experienced RVers comfortable with a higher level of personal financial liability responsibility.

- A popular choice for short trips and trailer rentals.

Standard

- Provides a balance of coverage and affordability.

- The most recommended plan for typical trips.

Premium

- Ideal for first-time RVers, long trips, and motorhomes.

- Offers the highest level of protection for added peace of mind.

Stationary

- Best suited for delivered RVs or stationary rentals.

- Provides coverage at a lower rate since the RV is not being driven.

Understanding the protection plans

Our protection plans vary in terms of deductibles, damage responsibility, and access to roadside assistance. This section defines the terms included in the protection plans, helping you choose the best option for your trip and ensuring you’re ready for any unexpected situations.

Deductible

The amount you’ll be responsible for paying in the event of an approved claim. Certain exclusions may apply depending on the protection plan you purchased.

Collision coverage

Covers the cost of repairs for damages resulting from the RV coming into contact with another vehicle or object during the rental period.

Comprehensive coverage

Covers the cost of repairs or replacement for non-collision-related incidents, such as fire, theft, or vandalism, that occur during the rental period.

Liability coverage

Liability covers you if you cause physical injury and/or damage to someone else’s property while using the RV.

Roof

- Premium: Lo’s RVRental covers costs beyond your deductible.

- Standard: Lo’s RVRental covers up to $5,000 beyond your deductible.

- Basic: You cover all costs.

Windshield

- Premium: Lo’s RVRental covers costs beyond your deductible.

- Standard: Lo’s RVRental covers up to $750 beyond your deductible.

- Basic: You cover all costs.

Awning

- Premium and Standard: Lo’s RVRental covers costs beyond your deductible.

- Basic: You cover all costs.

Towing distance

Receive towing services from the place of breakdown to the closest garage up to the allocated distance.

Fuel top-up

In the event you run out of gas, receive fuel delivery services up to the allocated amount.

Tire coverage

Lo’s RVRental covers the cost of a new tire up to the allocated amount.

Emergency lodging

If a breakdown occurs and interrupts your trip, get reimbursed for meals, transportation or lodging up to the allocated amount.

Mobile mechanic

A mobile mechanic will be dispatched to the location of breakdown for minor repairs fixable on site.

What to do if you need help?

Nobody knows their RV better than the host. If you’re having issues with the RV, the first step is to contact the host for troubleshooting.

If you can’t reach the host or can’t solve the issue, you should call Roadside Assistance.

It’s important to call Lo’s RVRental if any of the following situations apply:

- Damages to the RV

- Injuries as a result of a collision or comprehensive event

- Unresolved issues with the host or roadside assistance

- Abandonment of the RV

- Need additional assistance